Brick by Brick, Plank by Plank

One of the most popular assets women invest in, is bricks and mortar – property in other words. It may be a humble abode, to house you and your family. Alternatively, it might be an investment property, chosen to fund your retirement. Irrespective of what we spend our dosh on, we all buy property with the view it will increase in value. Unfortunately, despite being considered safe as houses, there’s no cast iron guarantee you’ll make money through buying real estate. Many buyers in recent years have found this out. Investing in dirt is no different from investing in other asset classes – it comes with risk. You can take steps however to minimize your risk – to arm against losing your hard-earned coin. At the same time, you can increase your chances of making your dollars and cents grow. To help you in these objectives, I’ve recounted below the main factors I consider when purchasing a roof and four walls. These matters have seen my investment in property do exceedingly well, hence I feel comfortable sharing them with you.

BIG INFLUENCES ON REAL ESTATE

Understanding the elements that influence property prices is the first step to minimising risk and increasing wealth. Real estate that’s in a country with a stable government and legal system, tends to appreciate at a greater rate of knots than those countries that suffer from volatility. This is because individuals will always seek to minimise their exposure to risk, particularly the risk of having their property seized through laws enacted by a government in power, lawfully or otherwise. New Zealand is a country that has established democratic governments and settled law for the most part. These aspects attract foreign investment in the property market as we all know.

A country’s taxation system also affects how property is viewed, both from a home and an investment perspective. When a nation’s taxation system supports and favors real estate, preferment as a choice of generating wealth will be heightened, driving people to choose property over other asset classes. When supply is limited, you can expect this to result in property price increases. If you apply this to Aotearoa you can see why investment in property has been so popular.

Lastly, cultural norms and values are factors that influence an individual’s investment behavior and choice. I think it fair to say, many Kiwis aspire to getting their feet onto the property ladder. Home ownership and owning an investment property or two, is culturally acceptable and viewed as desirable.

Summing up, the big influences that serve to make property purchasing and investing attractive operate in Kiwi Land.

NOT ALL PROPERTY INCREASES IN VALUE AT THE SAME RATE

Some properties experience greater price increases than others. Clearly, if you’re going to buy a home or an investment property or go into developing property, you want to be in the area that enjoys the largest increases in value in the shortest space of time. Price increases, that is capital growth, aren’t the only things you have to consider however if you’re intending on buying investment property. The rental return the property produces is also important. Much like capital growth, cash returns can vary from property to property.

Regardless of what camp you fall into, both homeowners and property investors want to maximise the capital growth and rental returns their property achieves. On the basis you’d like to know how to stack the deck in your favor in these regards, keep reading.

A picture speaks a gazillion words

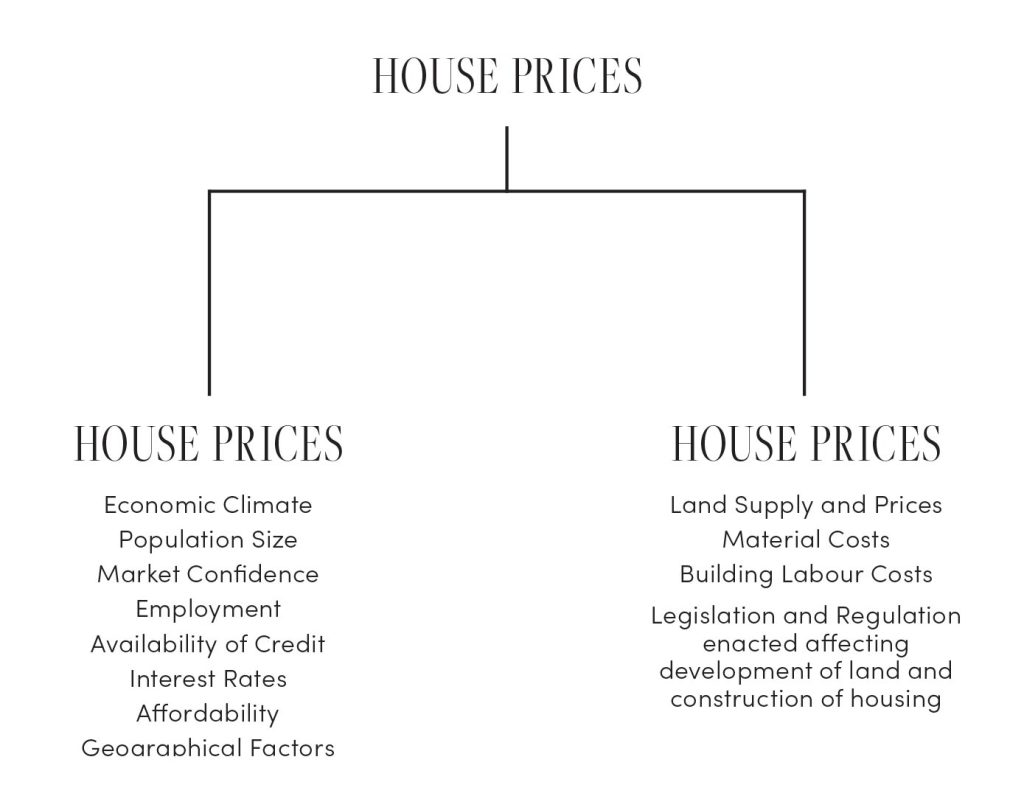

If we start with the big picture, we see rises and falls in property prices are caused by a myriad of factors but mostly by the natural change that occurs in demand and supply. Demand is influenced by the state of the economy, population size, market confidence, employment, availability of credit, interest rates, affordability (house prices to income ratio) and geographical factors. Supply on the other hand tends to revolve around land supply and prices, material and labour costs and legislation and regulation that permits land to be developed and more housing to be created. The chart below encapsulates these elements nicely:

Because space is limited and likely so is your time, I’ll elaborate on only a couple of these elements. The moo-la aspects we’ll leave for another day.

Population Size: Demand for housing is affected by population. Population is derived from three sources – natural growth, migration, and immigration. When the size of a population changes, so in general does house prices. That is, as population grows, so does the demand for housing. Everyone has to live somewhere after all. If housing is in short supply in an area where demand is growing, prices tend to travel one way – upwards. The opposite is also true. A dwindling populace can result in a decline in demand and ultimately, a drop in prices where supply outweighs the need for housing.

Applying this element to hedging your bets so the property you buy increases in price, you’ll want to purchase in areas where population growth is a natural phenomenon. By this I mean through people being born in a particular geographical area. This is because if the natural population is so strong it creates a demand of itself, the area won’t be reliant on migration or immigration to create the demand for housing. Consequently, if the population in an area grows through natural means that causes the area to suffer a housing shortage, property prices are likely to continue to appreciate. Additionally, demand won’t be reliant on bolstered migration and immigration. This is important because it de-risks your investment to a degree. Demand for housing that affects prices won’t be affected by unfavorable immigration policies enacted by the government of the day.

Employment Opportunities and Income: Most of us need to work to stack our coffers, earning enough money to keep body and soul together. Frequently, workers choose the area they intend to live in based upon the employment opportunities available to them. Cities tend to offer more prospects than smaller areas. People also seek to earn as much as possible from their job. Generally, urban areas offer higher salaries than smaller geographical ones. Employment prospects and high levels of income can positively affect properties capital values. This occurs when buyers who have the money compete to acquire a property. When several properties in an area rise in price, other properties in the same area frequently enjoy increases too.

Putting these two factors together, if you want to increase the chances of your property enjoying solid capital growth rates, purchase in a geographical setting where there’s plenty of employment opportunities, where higher salaries are on offer, and where a large number of highly paid employees dwell.

Geographical Factors: Other than employment opportunities, factors such as good schooling, access to different transportation methods, proximity to central business districts and features such as parks and beaches are attractive ingredients for a population. These ingredients serve to draw people to an area, creating demand. On the basis housing supply is short in that location, prices will increase as demand grows. It’s for this reason I investigate what an area has to offer and what type of people want to live in the area I’m considering purchasing in.

Location Forecasting and Spending: Did you know Governments, local authorities (eg: Councils) and some companies like Fletchers, spend thousands of dollars carrying out forecasting and formulating reports as to expected population growth and corresponding infrastructure needs? That’s not all either. Companies who are intent on buying land in an area, more often than not consider the demographics of the expected population in that location before they move in and build houses, supermarkets and petrol stations. They want to know what the race, gender, individual status, family composition, age and incomes are of the expected population as this reveals who their potential customers are and what prices they are likely to pay for the goods and services on offer.

Frequently a lot of the information gathered by the above parties is available to the public. Demand for housing, business development capacity, urban development activities, etc can be accessed by asking Councils and searching the net.

Understanding what the plans are for an area, be it roading, parks, amenities, and housing, can assist you in identifying where the anticipated population growth is. This permits you to buy in those areas at a much lower price than if you buy after the population growth has occurred. So a tip is to get in at the bottom, before the area develops and people start flocking to it, creating increased demand and pushing up prices. That way, the house you buy will enjoy a capital price increase as the area develops and the demand grows. Stonefields in Auckland is a true example of this.

Locality Wave: Following on from the above point of forecasting, sometimes if you have your eyes open and your ears to the ground, you can predict the next location that’s likely to experience an increase in property prices. You do this by identifying the suburbs that have already enjoyed increases in prices and then buy in the neighboring locations as price increases are likely to flow in waves to those adjoining localities. This occurs because those that can’t afford to buy in the areas that have spiked in price will seek the next best alternative. Usually, this is the adjoining suburbs. Buyers will purchase in the neighboring suburbs because those geographical areas will suit their purse. Through buyers shifting their buying to the adjoining suburbs, increased demand results and so does increase house prices, assuming a limited supply of property is on offer.

On the basis you purchase in an area yet to experience an increase in demand, you’ll likely buy at a price below what you would otherwise pay once the increased demand occurs.

SUMMARY

Much has been written and taught about property, particularly how to grow wealth through real estate. There are millions of books on the subject and just as many opinions. This article merely brushes the surface, providing points to ponder, which I’ve successfully applied in buying homes and investment property. Of course, to do either, most of us have to beg and borrow, usually from Banks and other lending institutions. Much like buying real estate, there’s some street smarts to getting a loan but that’s a subject for another day. In the interim, good wishes from me building your financial future, brick by brick, plank by plank.