How New Zealand SMEs Are Really Doing

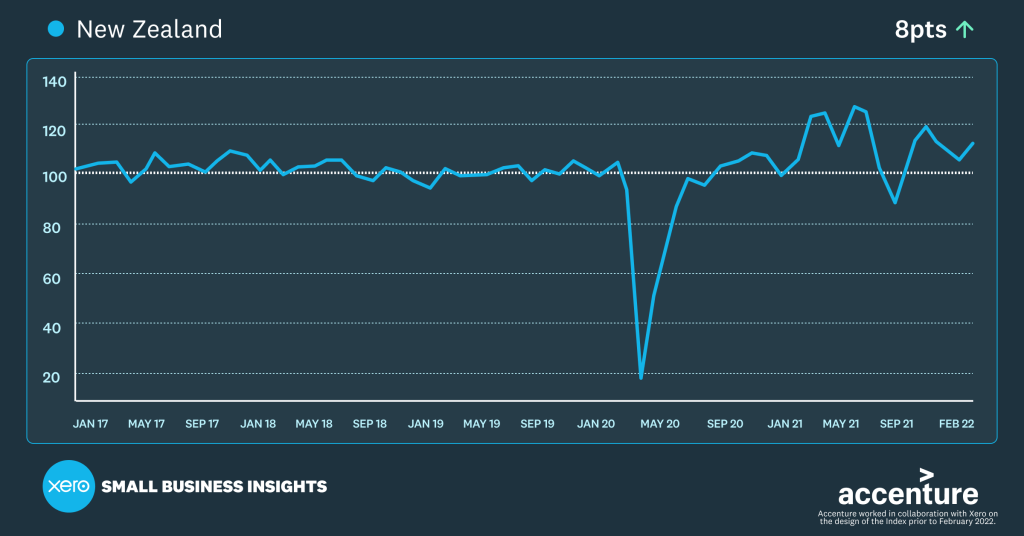

While it can be easy to be sidetracked by bits of negative social media sentiment and anecdotal conversation about the state of the economy and small businesses, it’s important also to look at the data. And the Xero Small Business Index provides an in-depth month by month dataset of New Zealand’s small business sector.

And the recently released Xero Small Business Index for February 2022, shows that overall SMEs have held up well against Omicron and the flow on effect of our battle with Covid over the last two years.

And even as Omicron cases surged in the community and we dropped any hope of “elimination” from our approach to Covid, there are some strong signs of resilience and optimism within the economy. The Xero Small Business Index not only provides some international context if you want to go and look at things on a macro level but a really clever index of metrics including employee hourly earnings, small business sales, small business jobs and even time to be paid, which is such a clever insight into SME health if ever there was one.

Here’s a bit of a snapshot of how well our SME sector is doing thanks to key Xero insights.

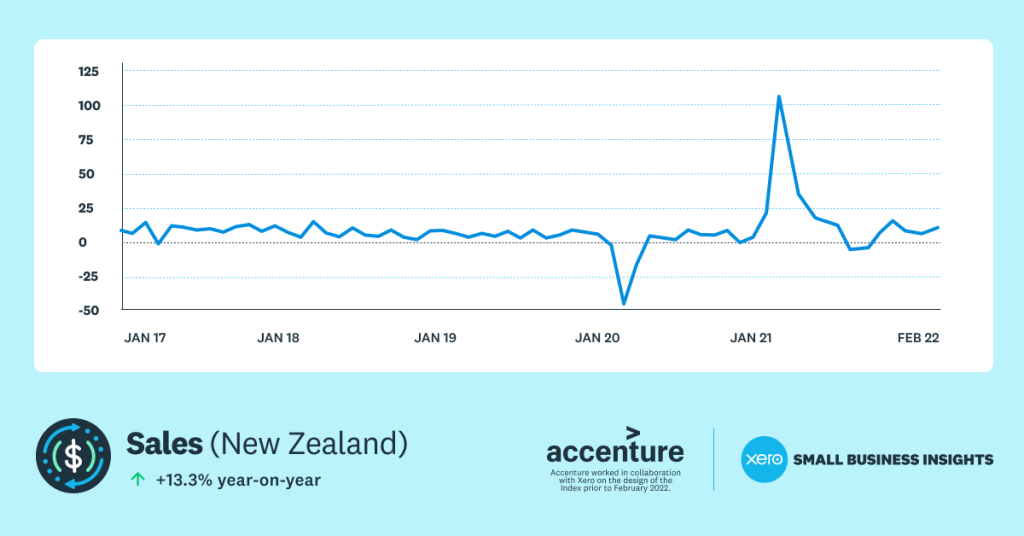

Sales growth

Small business sales rose a very strong 13.3% y/y. This is up on a 11.9% y/y rise in January. Auckland (+17.1% y/y) led the way while the smallest increase was in Otago, with 8.9% y/y.

Construction (+16.8% y/y) and manufacturing (+15.7%) were the strongest industries in terms of sales while the only sector to record a decline was hospitality, down 3.0% y/y.

Xero’s Managing Director for New Zealand & Pacific Islands, Craig Hudson sums up some of the consumer sentiment driving these results. “While New Zealand has never seen such high numbers of Covid, our small business community is now used to adapting to disruption. The data shows the sector has done incredibly well so far with Omicron, however, there are still challenges ahead with cases peaking in March.

“Hospitality was the only sector to see a decline in sales in February, down 3 percent y/y. Month in, month out, the data shows the hospitality sector is bearing the brunt of Covid’s impact. We need to be doing everything we can to support these small businesses as they face these tough times,” says Hudson.

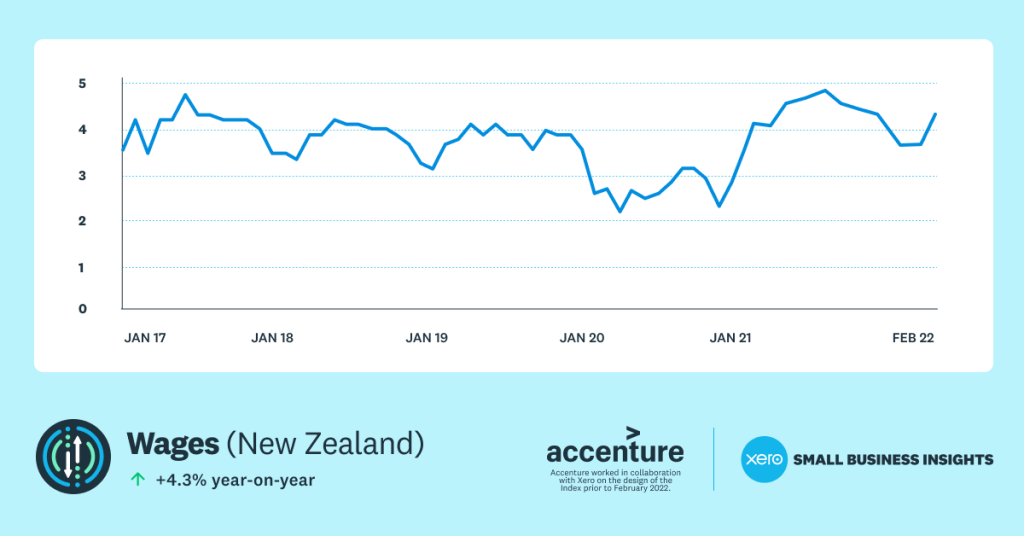

Employee Hourly Earnings

Wage growth accelerates sharply. Wages rose 4.3% y/y in February, after a 3.7% y/y rise in January. This reflects genuine growing wage pressure as competition for staff intensifies. All sectors recorded faster wages growth, led by construction (+5.1% y/y) and hospitality (+5.0% y/y).

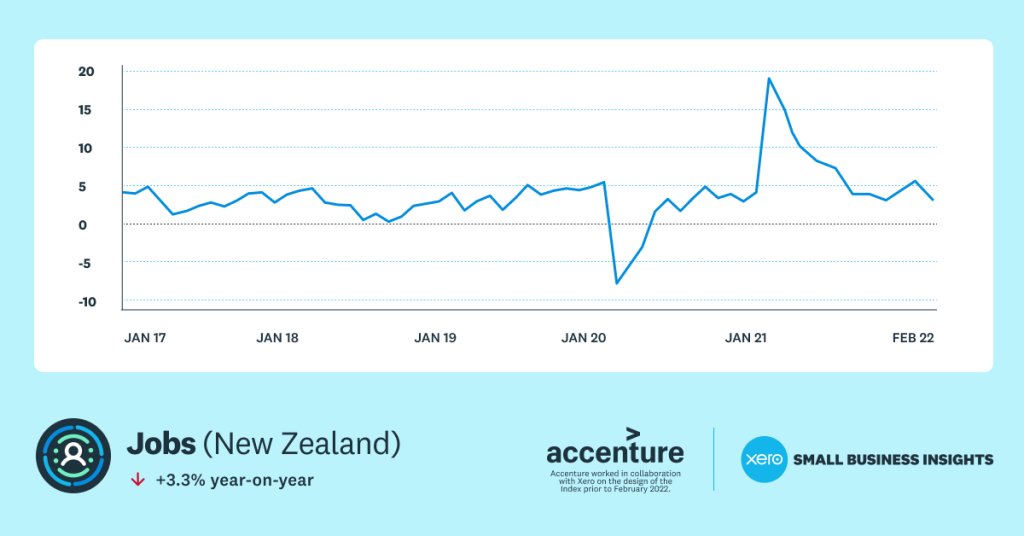

Small business jobs

This one is a contentious one at the moment with salacious newspaper reports about high paying Kiwi fruit picking highlighting the impact that border closures have had on our talent pool. But in spite of this pressure the overall jobs growth for the SME sector, in general, is still up 3.3% y/y, although down from a 6.0% rise in January. The strongest region for jobs growth was Otago (+5.5%). This, in part, is due to the weak result in February 2021 when jobs rose just 0.5% y/y. Wellington (+4.8% y/y) and Canterbury (+4.7% y/y) both recorded solid results. The jobs gains were led by professional services (+9.2% y/y) and construction (+5.7% y/y). One of only two sectors to record a decline in jobs during February was the aforementioned agriculture sector (-4.0% y/y).

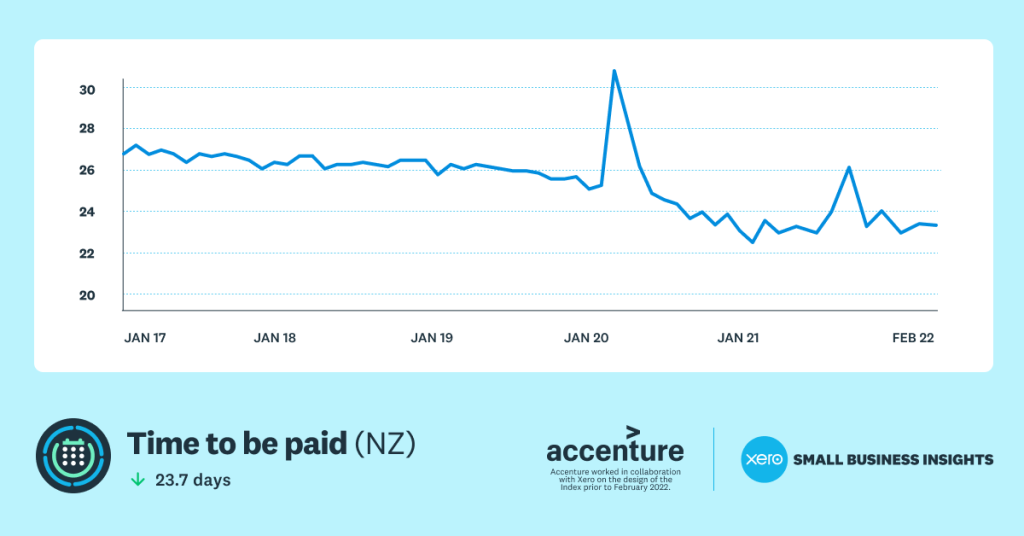

Time to be paid

Again, such a clever dataset for economic sentiment and thankfully time to be paid has had little change. Small businesses waited an average of 23.7 days to be paid in February – similar to the 23.8 days in January. There was, however, a rise in late payments from 5.9 days to 7.0 days. The lack of a similar shift in time to be paid suggests this is likely to be temporary and due to a compositional shift in the sample’s payment terms for this month.

Putting it all together

Overall, the Xero Small Business Index comes in at 114.5 points. And 8 point rise from January. And while this kind of thing does seem a little unfortunate to gloat about, we have outperformed Australia’s Small Business Index which rose slightly to 102 points and the United Kingdom at 86 points.

So while there will no doubt be more headwinds as inflationary pressure, the Ukraine invasion, supply chain issues create further ripple effects, the New Zealand SME sector has shown an incredible amount of resilience so far and there’s a lot to be optimistic about especially when you go beyond the headlines to the data.