Money Talks 3: Cooking Your Investments

You can’t make an omelette without breaking a couple of eggs and generally, you can’t grow your wealth without investing. Investing, however, comes with risk. People implicitly realise this. Unfortunately, what they don’t appreciate is, risk is like the variety of omelettes a good cook can make – there are many different kinds.

TYPES OF RISK

Loss of seed capital, being the original funds invested, is predominately the risk that crosses most people’s minds when investing. Other forms and levels of risk exist, however, which wise investors give equal consideration to. For instance, there’s income risk, meaning the investment made doesn’t produce the amount of income forecasted. Return risk is another possible risk individuals should be mindful of, resulting in the investment failing to produce the returns predicted. Ever present is inflation risk. If this occurs, the value of the investment made won’t be keeping pace with the cost of living. Finally, interest rate risk may crystalise. This could mean the interest an investor pays on the money they’ve borrowed to make the investment, has grown to such a point that it negatively affects the income received from the investment, or reduces the return on the investment from that which was projected. These categories of risk can exist regardless of whether you’re buying shares, purchasing commodities, trading currencies or acquiring a property or a business. Common to all these different risks is the propensity to bring about volatility being fluctuations in the value of your investments.

UNDERSTANDING THY SELF

My palate in relation to omelettes is pretty plain. There’s good reason for this – anything spicy tends to upset my stomach. My breakfast omelettes comprise eggs, milk, spring onion and a dash of ground black pepper. My best friend, on the other hand, likes the Michelin Star kind of omelette, filled with gruyere cheese, ham, mushrooms, tomatoes, peppers and plenty of herbs thrown in for good measure. Her palate is much more sophisticated than mine. Then again, spicy food isn’t an issue she grapples with. Individuals’ attitude to volatility is much like this. Our levels of tolerance and acceptance differ. Some people are genuinely tolerant of volatility. Others find the notion of their investment going up and down in value, brings them out in a cold sweat. This is where risk profiling comes to the forefront. Your risk profile denotes how tolerant you are to accepting volatility in order to achieve the return on investment you make.

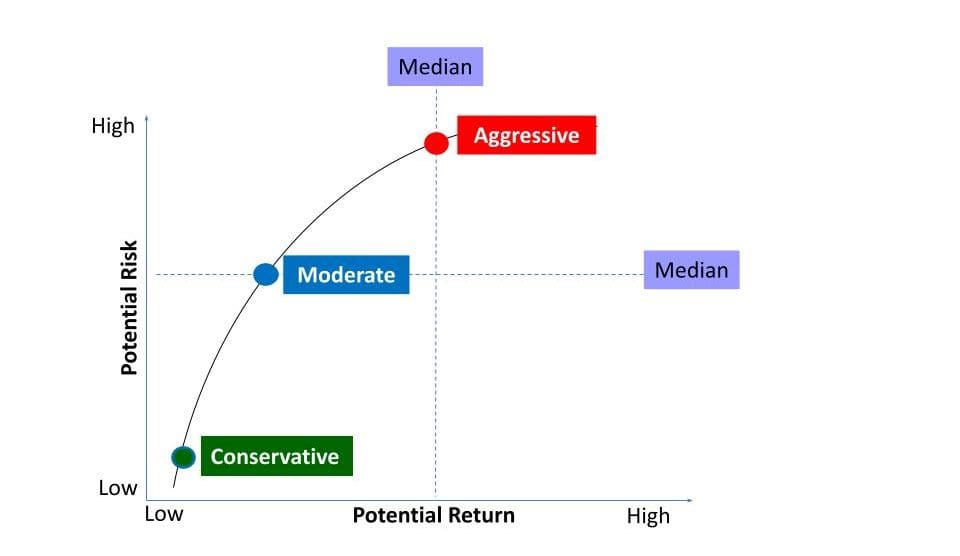

Historically, individuals were told they had a conservative, moderate or aggressive profile but I think this is too limiting. There are points in-between these classifications as this diagram shows.

Having a really good understanding of your own risk profile assists you to select investments that let you sleep at night as opposed to those that leave you counting bar lambs for hours on end.

Those with a conservative profile will value protecting their original capital above achieving returns. They’ll be willing to accept fairly low returns to achieve stability and prevent loss of seed capital. They won’t be overly concerned about the effect inflation has on their investment. They will, however, want quick access to their capital so liquidity will be a very important element when choosing investments. Moderately conservative individuals are more accepting of some risk to achieve returns but will still have a very strong focus on preserving the original funds they’ve put into the investment. Liquidity will also be somewhat important to them. People who are comfortable accepting quite a bit of risk in order to achieve greater investment returns over the long term are usually classified as possessing a moderate risk profile. They won’t be concerned about liquidity and they’ll prioritise accumulating assets and increasing capital over earning income off their investments. Those willing to take on significant risk to achieve higher returns will fit into the category of possessing a moderately aggressive risk profile. Protecting their original capital invested will take a back seat to achieving higher returns. Cash flow and liquidity aren’t likely to be factors that weigh heavily on their mind. Finally, we come to people with an aggressive risk profile. Capital appreciation opposed to capital preservation will be their focus. Liquidity won’t concern them at all.

INFLUENCING FACTORS

Certain factors can influence an individual’s profile. Investment objectives, level of investment knowledge, taste for risk, investment timeline, duration to retirement, personal circumstances such as employment status, family responsibilities and financial capabilities all impact upon an investor’s risk profile.

IDENTIFYING WHERE YOU SIT

To work out your own risk profile, you can ask yourself some pertinent questions. For instance, consider what your answers would be to the following:

- What does the concept of risk mean to me? Does it represent danger or opportunity?

2. What is my main priority? Is it protecting my seed capital or growing the capital I’ve sunk into the investment? - How long do I have before I need to cash up my investment?

- How much time and income-producing years do I have ahead of me to make up for any losses my investment may experience?

CHANGING STATUS

Profiles shouldn’t be fixed. They can alter over time and through changes in circumstance. For instance, we may sit on the conservative spectrum of risk profiling but then receive an inheritance, which enables us to take on more risk. As such, we may become more willing to accept greater volatility and thus change our profile to that of moderate. Likewise, we may grow our knowledge and correspondingly, our confidence and feel more inclined to accept volatility, thus shifting our profile classification from moderate to moderately aggressive. Conversely, we may have an aggressive risk profile initially when investing, but as we take on greater family and financial responsibilities, or as we get closer to retirement, we may need to adopt less acceptance to risk. Accordingly, it may be sensible to move our risk profile down a notch or two.

The above are just some examples of why I advocate a regular risk profile review by a professional advisor. People change. Lives evolve. Having a child or losing a job are major life events. They have the capacity to affect our investment time horizons. Additionally, changes we experience in our net worth or income, such as receiving an inheritance or suffering a business loss, can alter our focus from acquiring wealth to preserving it. Likewise, the closer we come to realising our goal, the more warranted may be the need to shift our profile. These are all triggers that call for a risk profile review. By completing this examination, investments can be checked to ensure they remain appropriate to the investor’s current and anticipated circumstances and risk profile.

SUMMARY

Risk profiling is the province of financial advisors. They want to understand the degree of volatility you’re comfortable with before suggesting investments. Profiles are applicable to an individual and so is investment advice. Investing in congruence with your profile helps you and your advisor select investments that are appropriate for you and your situation.

There are particular tools you can use when investing, which reduce volatility. Next month’s article will concentrate on this. By implementing these, you may feel more comfortable and have greater confidence when investing. Consequently, the risk profile you consider yourself to possess may well be different from the one you end up adopting. This is another reason it’s imperative you obtain advice before embarking on investing.

Talking of action, remember the antidote to fear of investing is procuring knowledge and taking professional advice from qualified financial advisors. As always, happy learning and investing from me.

Ciao

Janet Xuccoa

Read more from Janet’s Money Talk Series here.