Money Talks 4: Investing and Instincts

Instinct can be defined as those innate behaviours we exhibit towards a particular activity. For instance, I’m pretty sure my instincts would tell me to run from danger if it presented itself in the form of a sabre-toothed tiger. Likewise, I can guarantee my instincts will fuel me to eat a box of Milk Tray chocolates if they happen to be put in front of me. Relying upon my instincts to run from danger is a sensible move. Trusting my instincts to guide my food choices, so I consume chocolates over carrots on a daily basis isn’t such a smart play for my general health. The same comparison can be made in respect of our existence. Our instincts have literally enabled us to survive and evolve. That’s why we are one of the oldest species that inhabit planet terra firma. Relying upon our instincts to guide our investing behaviour, however, more often than not leads us up the creek, around the mulberry bush and into a dirty ditch.

EMOTIONS AND BIASES IN ACTION

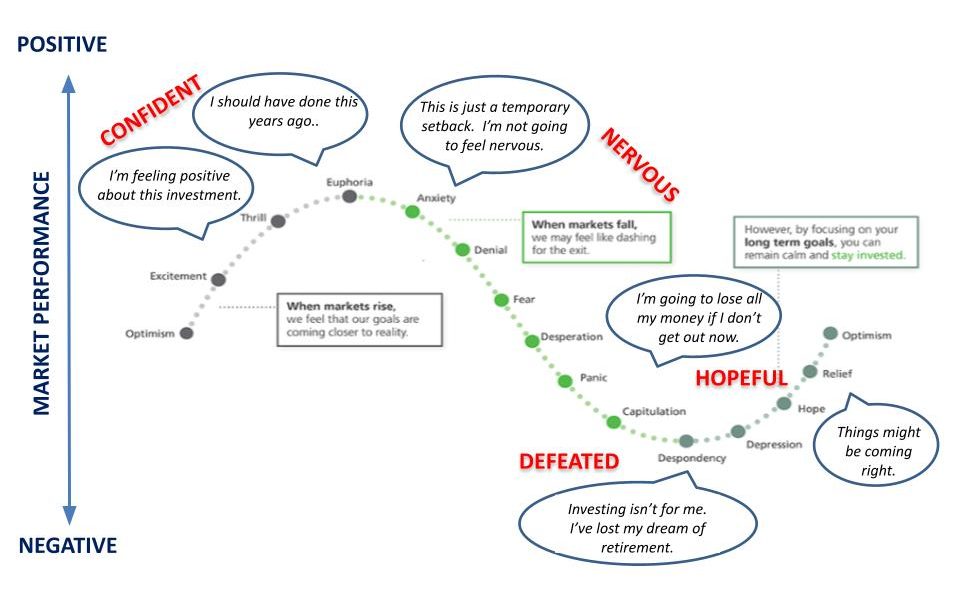

Covid, Delta and Omicron don’t just affect our physical and mental health. These viruses affect investment markets, creating lots of volatility. It’s for this reason, possessing an awareness of our emotions and their corresponding influence on our behaviour, is vital if we are to successfully navigate and triumph in our financial lives. With this in mind, have a look at the diagram below. It summaries the emotions we all experience when investing.

EMOTIONAL INVESTING TRAIN WRECKS

We can compare the emotions we feel when ploughing our gold coins into investments, to those we experience when taking a long train journey. Initially, when we make an investment, we commence our journey at the optimism train station. Possibly, we took up the investment because others around us were doing so. The bandwagon effect thus prompted our financial investing behaviour. Alternatively, we may have feared missing out on what we perceived as an opportunity, so FOMO drove us. Irrespective of the origins of our inspiration, as our journey progresses and our investment increases in value, our emotions become heightened. We dock at the excitement, thrill and euphoria stations. Confirmation bias sets in when our investment results confirm our initial belief that the investment was a “good one”. We congratulate ourselves for following our instincts and taking up the investment.

Like all long journeys, however, our emotions change as travelling time drags on and terrain becomes difficult. This is usually seen when markets experience volatility and our investment experiences a fall in value. When markets commence their descent, our train stops at the anxiety station. We tell ourselves the decline is just a temporary setback. If, however, markets don’t rebound, our train pulls into the denial and fear stations. Around this point in time, loss aversion bias kicks in. As humans, we tend to experience greater pain from a loss that befalls us, than pleasure from an equivalent gain. Loss aversion bias leads us to be reluctant to sell our investment. We know if we liquidated our investment, we would inevitably experience pain as we will receive less money than we anticipated due to the investment decreasing in value. If markets continue to fall, our investing train will move onto the desperation and panic station platforms. Finally, we will land at the capitulation station, where our instincts will drive us to sell our investments in a bid to avoid further loss.

We have now just committed one of the greatest sins in investing – we’ve purchased at the high point of the market cycle and sold at the bottom. In other words, we’ve bought at top dollar and sold at a loss. Interestingly, the converse applies too… smart money often buys investments at this point because this is where they make the most money. This does, however, require insight and tight control of emotions and instincts. Understanding and predicting market cycles is a topic best left for another day.

Reverting back to our train journey, some investors will feel the pain of their loss acutely. These are the investors whose train has permanently stopped at the despondency and possibly, even the depression stations. They will focus on their loss, become overly pessimistic and attribute the poor result their investment has recently experienced to all other types of investment, including high quality investments. This is recency bias in operation. Their instinct never to experience loss again, drives them to never invest again, thereby depriving themselves of the opportunity to grow their wealth.

As we know, markets rebound. When markets turn, investments begin to show positive returns. For those still riding the investment train, the upward ascent begins. We dock at the hopeful station when it appears markets are turning positive. When our train pulls into the next stop, we breathe a sigh of relief as the market continues its ascent and the value of our investment grows. Our feelings become positively optimistic when our train gains momentum, continues on an upward track, with markets and the value of our investments mimicking the upward projection. We congratulate ourselves on following our instincts and holding onto the investment. Our train is now back at its original station from where our investing travels commenced and the whole journey begins again.

TRUSTING OUR INSTINCTS AND EMOTIONS

A quick look back at evolution shows instincts and emotions have served us well. They’ve literally kept us alive. Relying upon those same instincts and emotions to guide our behaviours when managing our financial lives and investing, is unlikely to deliver the same results as the train journey example shows. Buying high, selling low, losing money and suffering emotional highs and lows is no way to live a financial life. So how do we manage our investing journey when all our instincts are screaming, telling us to cash up? The suggestions below may help you bring balance to your investing scales:

- Take advice from a professional before investing. Be honest when working with them. They can only help you formulate an investment plan that suits your risk profile and circumstances if you are upfront with them. The investment plan they construct, will contain objectives, strategy and timelines. It will be the blueprint for your investing activities. In times of trouble, you will pull out your plan and all things being equal, it should give you confidence and comfort. It should at least stop you panicking.

- Develop an awareness of emotions and an ability to control them. Understand markets are cyclical – they are meant to go up and down. This means the value of our investments will rise and fall. Remembering this should serve to temper your emotions and instincts.

- On the basis the investment you made is a good quality one, and it should be if you are taking advice from a professional advisor, know its value is likely to rebound over time. The fall you see in the market and correspondingly the value of your investment, is only a “paper fall”. You don’t experience that fall/loss unless you crystalise it, and that only occurs if you sell your investment.

- If you feel worried, don’t hit the “sell or exchange button”. Many an investor has done that in recent Covid times when markets encountered extreme choppy waters. They’ve sold their investments at reduced values, thereby depriving themselves of future opportunities to increase their wealth through those very same investments. Alternatively, they have swapped investments, for conservative ones. As such, their wealth hasn’t grown because their investments haven’t enjoyed the upswing investments overall have experienced when markets improved. An example of this in play is many New Zealanders swapped out of growth KiwiSaver schemes into low growth funds when Covid first darkened our heath. They did this because they saw their KiwiSaver balances dropping at a large rate of knots. Consequently, they deprived themselves of the increase their KiwiSaver balances would have enjoyed when markets rebounded. All they needed to do was take a deep breath and stay the course. Behaving in this manner has literally cost many Kiwis thousands and thousands of dollars. The point is, don’t react by selling or exchanging investments. Revise your investment plan and speak with your advisor before embarking on a course of action.

- Adopt a long-range perspective. Rome wasn’t built in a day, and neither is true solid wealth. It takes time to multiply the gold coins. Put in the time miles. Give time, time.

SUMMARY

Good quality decisions are often made by taking the emotion out of them and holding instincts in check. This truism applies to investing. Comprehension and clarity are found in non-emotive mental settings. Building, growing and maintaining good quality investments is easier when we are not driven by emotions and instincts. The points above should help you exhibit these behaviours in your own investing activities. As always, happy learning and investing from me.

Ciao

Janet Xuccoa

Read more from Janet’s Money Talk Series here.