The scars never fade

Givealittle doesn’t have to be your only option if illness hits, says Stephanie Wiki, you have options. Not because the proverbial ambulance at the bottom of the cliff isn’t useful. It is. But before crisis strikes, she wants people to know they hold the power, and can create some certainty in their life. Wiki is fiercely passionate about that because for her, it’s personal.

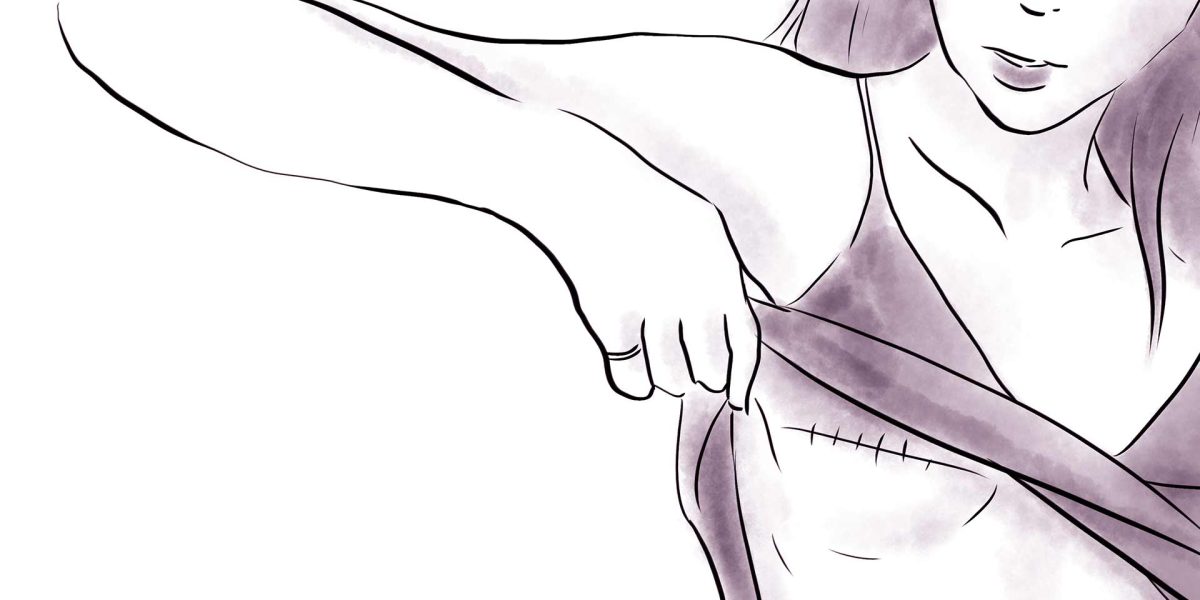

There’s nothing pretty about breast cancer. Not Aotearoa New Zealand’s soaring statistics, and not the potential for a lifetime of treatment, surgeries and worry that can accompany a diagnosis. Without wanting to add to those numbers, thirteen years after her last surgery, this month Stephanie Wiki’s breast tissue scars are about to be cut open.

“I was getting dressed this morning and suddenly I thought, ‘Oh s***, my scars across the middle of both breasts that have finally faded are being opened again’. It’s almost like I am back to square one,” she says.

In 2011, the week of the Christchurch earthquake, Canterbury resident Wiki, then aged 40, received her breast cancer diagnosis. Today, the 54-year-old is not only a survivor, she’s a thriver, and she’s helping others to be the same in her role as a health, trauma and life insurance advisor.

But Wiki’s recovery didn’t come without tough realities along the way, including this latest surgery to remove her ruptured implants — given that an estimated 10% of breast implants rupture within 10 years, however, this is not unexpected.

“Surgeries, reconstruction and treatment is a long, drawn out process,” says Wiki. “It’s not like you have your boobs chopped off, then you have reconstruction, and it’s done.

“They remove your breasts, then put in saline expanders because they’ve taken every bit of tissue. That then gets injected every week to slowly stretch your skin over months. Then they cut you open to remove the saline implants and put in the ones that are going to be there forever. It’s a very real process.”

When it comes to her clients, Wiki encourages them to have a “big kahuna of a policy where they can”.

Today, her intimate experience with health, trauma and income protection insurance policies — knowing that the devil really is in the details — have powered Wiki to champion her clients to get what they deserve when it comes to their insurance cover. And she’s with them every step of the way, knowing what to claim for and when.

“I don’t expect my clients to know their policy line by line. That’s my job,” she says, adding that, “When you need immediate support in a situation, that’s when I step in because when you’re sick, you need to be “100% focussed on getting well.”

Following her own diagnoses, Wiki says she was fortunate that her friend, also an insurance advisor, was to take over helping with her claims, “because I was just worried about staying alive,” she adds.

As CEO of Wiki Group with 30 years insurance advisor experience, Wiki starts every conversation with new clients with humility, saying, “You have to really trust me”.

“I tell them ‘I need to know more than your doctor, your lawyer, your accountant, your financial planner and your specialist’,” she says. “I need to know it all.

“If you go to your doctor, you’re going to tell them all about your medical condition and how you’re feeling. You’re not going to talk about your financial situation, or your legal worries. If you go to your accountant, you’re not going to talk about your health. I have to ask all of those questions, and it’s a real privilege.

“I need to understand their situation at a holistic level and they have to trust that I’m that person for them because I’m literally there for the lifetime of their policy.”

Back to her own experience, Wiki needed a second lot of surgery, which was deemed cosmetic, saying “It’s not cosmetic in my eyes when it’s reconstruction.”

“There’s nothing cosmetic about breast surgery after you’ve had cancer and your breasts have been removed,” says Wiki.

Her rollercoaster experience fuelled Wiki to become a fierce advocate for people understanding their choices and breadth of their cover when it comes to their health and well being outcomes. She’s also been a fervent supporter of the Breast Cancer Foundation NZ since she started in her career, which has helped inform some of their lobbying.

“We’ll use me as an example,” she adds. “From my breast cancer diagnosis to my surgery, it took one week to have bilateral mastectomy and get reconstruction started. All of my oncology and surgeries were in private, so I didn’t need to go to the public hospital,” she adds.

“Now I’m having more surgery to replace my implants, but I’m not waiting. It’s more just when it fits in with me and my surgeon. If I was having to do this on the public system, I seriously don’t know what would happen.”

Wiki credits New Zealand’s health system as being “very good if you’re in an acute health situation”, adding, “you’re going to be looked after, we’re very lucky in that”.

“But say while you’re in hospital they find endometriosis, they’re not going to address it then. You’ll go on a waitlist because it’s classed as elective surgery, even though no one is electing to have endometriosis.”

Wiki illustrates this with another story. As a speaker at Pink Ribbon fundraising events over the past decade, Wiki has met women at every age and stage. One she met five years ago had excellent health insurance, but Wiki — a mum to daughter Tori and son Kaleb, and her four mokopuna, Frankie, Sonny, Ziggy and Boh, and husband Tai — suggested “I really want you to get life and trauma cover for your children while they’re still healthy”, they were 21 and 23 at the time, and already had health insurance.

“So we added extra cover,” says Wiki, “then 18 months later her daughter went to hospital with a twisted ovary. There they found ovarian cancer, and she had to have an ovary and the tumour removed.”

The diagnosis triggered a trauma claim, which Wiki stepped in to facilitate, where “she received a lump sum payment. The money she received has now been put aside in case she needs to freeze her eggs or have fertility treatment in the future” says Wiki.

“Here’s a 25-year-old woman in a s*** situation, and it becomes a beautiful story because now she’s able to take control of her future.”

Wiki adds that while Pharmac confirmed in September this year it would fund some life-extending drugs for some cancers, she urges people to find out whether they have cover for other non-Pharmac drugs, because many policies do not.

“If something happens and you put in a claim when you’re sick and something you thought was covered is not, it’s trauma on trauma. With all my clients, I review their situation every year and ask the right questions to understand where they’re at. Like I tell my clients, they’re my partners for life.”

She uses a recent example of a chat over a birthday dinner when a woman told her she didn’t have to worry because her policy had everything covered.

“She told me which company she was with and that they pay for the highest cover, and I said, ‘Okay, I could be wrong, but I’m 99% sure that you don’t have this cover’. But without really knowing what the policy covers, it doesn’t mean that you do actually have cover for non-Pharmac drugs, which can add up, costing hundreds of thousands of dollars.

“She came back to me and I can now definitely tell you, her policy does not cover non-Pharmac drugs. I told her options for adding on extra cover, and now she can confidently make the choice while she’s well, not when she’s sick.

“It’s a very different story to putting in the claim when you’re sick and finding out it’s not covered.”

Wiki adds that maintaining mental wellbeing is critical when you’re ill, and having the right team onboard in time of crisis helps.

“When you’re sick, the last thing you need is financial stress. I don’t know one person who wouldn’t find that really hard to cope with. I know of people who have had to sell their houses, or set up Givealittle pages because their treatments aren’t funded.

“There are New Zealand insurers that do cover life-extending drugs. You just need to know which ones and have the policy to suit your needs. But it’s not just treatments, if there’s a major health problem we also need to look at how we can protect your mortgage and your income.

“When I got sick, my income was very well protected. But who’s now going to pay my husband’s wages? Because he had to take six months off work to look after me. That’s where my trauma insurance came in. You need to consider whether people may need to take care of you.”

Like a mortgage advisor, a health, trauma and life insurance advisor is paid a commission from the insurer. This means the cost to the client remains the same whether it’s direct, or through a broker. But, says Wiki, “if you choose me as your insurance advisor, you get the benefit of me understanding your situation at a holistic level, and I really am that partner by your side.”

In just the last two months, Wiki sorted trauma claims for a 25-year-old who was in a major car accident, the 25-year-old with ovarian cancer, a 58-year-old male with prostate cancer, and a 52-year-old male in aortic aneurysm.

“When I get to say, ‘just get yourself well, I’m dealing with it. You don’t need to worry,’ it’s an absolute privilege.

“I used to feel like the Lotto lady when we used to deliver a big cheque,” she laughs. “Now it just goes into their bank account. But it’s still a thrill and an honour, and I get to do that everyday.”

The Facts

In 2024, breast cancer remains a significant health issue in New Zealand. Here are some key statistics:

Incidence:

Approximately 10,656 cases of breast cancer were reported, with 85% being invasive.

Survival Rates:

The 10-year survival rate for breast cancer patients is around 85%, and it increases to 95% if the cancer is detected through a screening mammogram.

Mortality:

Sadly, more than 650 women die from breast cancer each year.

Screening:

The number of cancers detected through screening methods has increased over the past four years.